Italy Climbing Shoes Market Overview

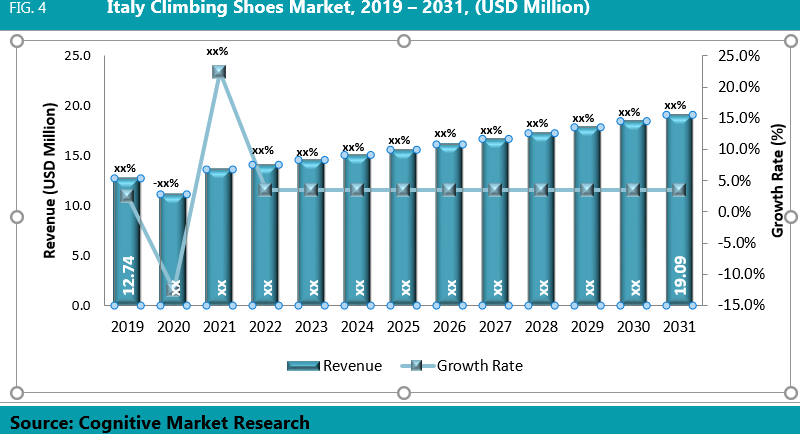

Italy Climbing Shoes Market, 2019 – 2031, (USD Million)

The Italian market for climbing shoes is a constantly shifting environment driven by a variety of factors, from trends in outdoor recreation to technological developments in shoe design. Italy, a country well-known for its long history of outdoor activities and handicrafts, is a major participant in the climbing industry worldwide, accounting for a sizeable share of the climbing shoe market. Leading manufacturers in climbing footwear, including La Sportiva, Scarpa, and Tenaya, depend on decades of experience to produce shoes that are specifically designed to satisfy the needs of climbers of all skill levels and disciplines. These businesses are always improving their designs by using modern materials and construction methods to improve comfort, grip, and sensitivity. For instance, Scarpa is a manufacturer founded in Asolo that specializes in shoes for climbing, mountaineering, trekking, hiking, ski mountaineering, and telemark. Scarpa suggests the Quantix SF paradigm for climbing, which works well on long routes and crags and can be used to any kind of rock. Moreover "Made in Italy," Wildclimb shoes are part of the M&M Calzaturificio di Montebelluna business, which has over 25 years of experience producing mountain shoes. The different models for sport climbing are based on four different climber types and how well they can use and elevate their feet. Rubber research, woven cottons, laser processing, and microfibers are all made to be comfortable and effective.

The market for climbing shoes in Italy has grown significantly in recent years, driven by a rise in outdoor sports enthusiasts and the sport's inclusion in international competitions such as the Olympics. A growing number of enthusiasts are looking for specialist footwear for indoor gym climbing, bouldering, sport climbing, and traditional climbing as a result of this rise in popularity. Some of the application of shoes include neutral, moderate and aggressive shoes having its own benefits and features with all the types of price ranges including low, moderate and high price range

The market for climbing shoes in Italy has been significantly impacted by the growth of indoor climbing gyms. The need for shoes designed for indoor use is increased by these facilities, which offer climbers a comfortable and accessible place to train and practice all year round. In response, manufacturers have released models designed to perform exceptionally well on artificial climbing surfaces. These models include characteristics like improved edging performance and better durability to handle repeated use on gym walls.

The methods that climbing shoes are distributed in Italy have also changed; internet retailers and specialty outdoor stores are now competitors for conventional stores. Customers looking for convenience and a larger selection of goods are increasingly turning to e-commerce, while enthusiasts seeking specialized services and knowledge are catered to by niche businesses.

With further design advancements, rising climbing-related activity participation, and more environmental sustainability consciousness, the future of the Italian climbing shoe business looks positive. Italy will continue to lead the climbing sector as long as climbers stay at the forefront of the competition on both natural and artificial environment. This will be made possible by the continued demand for high-performance footwear that is customized to meet their unique needs.

Italy Climbing Shoe Market by Application, (2019-2031)

On the basis of application, the market was segmented into Neutral Shoes, Moderate Shoes and Aggressive Shoes. Moderate Shoes accounted for the significant market share of 47.46% in 2019 and will reach 50.84% in 2031. The design of moderate shoes is a bit downturned, or cambered, which is what makes them suitable for difficult climbing. Slab routes, crack climbs, lengthy multipitch climbs, and sport routes with a slight overhang may all be handled with these all-purpose shoes. These shoes fit loosely for comfort that lasts all day. Your toes can rest flat within the shoes because of them.

Some of the benefits of this type include:

• Downturned shape puts your feet into a stronger, more powerful position than neutral shoes, helping you climb more challenging routes

• Typically have stickier rubber and thinner soles than neutral shoes for better grip and feel

• More comfortable than aggressive shoes

For instance, the all-around, Italian-made climbing shoe Finale has gone through a technical and visually appealing redesign that makes it suitable for both the gym and the cliff. Long routes are ideal for the more comfortable climbing shoe, Finale. Maximum consideration for the environment and the sustainability theme is demonstrated by the upper in metal-free eco-tanning, laces made from recycled materials that have reached the end of their useful lives, and soles made to make it easier to resolder, a technique that prolongs a product's life while protecting the environment. Superior grip and durability are made possible by the Vibram XS-Edge compound, and the redesigned heel design both improves comfort and shields the heel. For people who are new to climbing and are searching for a comfortable shoe, this is the ideal option to use in climbing gyms or on multi-pitch routes. (Source: LA SPORTIVA)

Moreover, their affordability compared to high-performance shoes makes them accessible to a broader demographic of climbers, including students, casual climbers, and outdoor enthusiasts, contributing to their significant market share in Climbing Shoe Market.

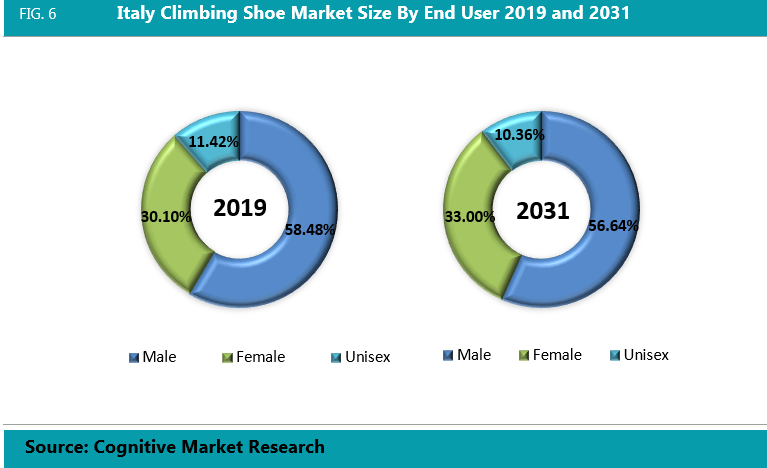

Italy Climbing Shoe Market by End User, (2019-2031)

On the basis of end user, the market was segmented into Male, Female and Unisex. Male segment accounted for the significant market share of 58.48% in 2019 and will reach 56.64% in 2031. Climbing was once seen as a largely male activity, with men making up a greater percentage of the Italian climbing community. Men make up a sizable share of the client base in the climbing shoe market, which is indicative of this trend in consumer behavior. For instance, according to the data, climbing is Italy's seventh most popular sport, men being the majority players in the climbing activity. Considering the whole, according to IFSC world cup In total, 235 climbers, 128 male and 107 female, registered to participate, representing 37 countries and territories, and four continents. This indicates that the participation level of male is more than female and unisex.

Male climbers' choice and demands have been provided for in a broad variety of climbing shoe options, which has further led to their dominance in the market. In order to meet the different skill levels and climbing preferences of male climbers, manufacturers frequently give priority to the creation and marketing of climbing shoes. These shoes come in a wide range of styles, designs, and performance qualities. Men's prominence in the climbing industry is further established by factors like funding of male athletes, media representation, and cultural attitudes, which have an impact on their shoe purchases.

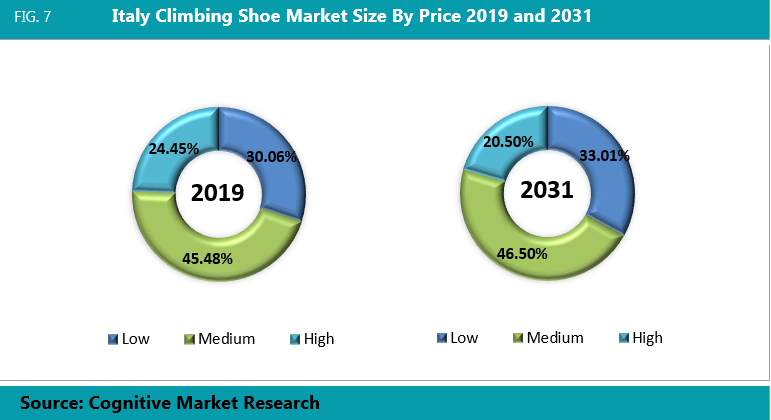

Italy Climbing Shoe Market by Price, (2019-2031)

On the basis of price, the market was segmented into Low, Medium and High. Medium segment accounted for the significant market share of 45.48% in 2019 and will reach 46.50% in 2031. Medium-priced climbing shoes are suitable for the wide range of customers that make up the Italian climbing community, which includes climbers with different budgets and preferences. While high-end, high-performance alternatives are available, as are affordable, entry-level shoes, medium-priced shoes offer a good balance between reasonable pricing and respectable performance attributes. For instance, according to the SCARPA, La Sportiva, the price ranges are from 0€-50 € for low priced climbing shoes, 50€-99€ for the medium and 100€ above is higher priced. The medium prized climbing shoes value both durability and performance in their sporting goods, and shoes in the middle price range frequently provide both needs without requiring a large amount of money. While still being reasonably priced, these shoes usually combine premium materials, modern technology, and well-considered design aspects to improve climbing performance. Additionally, because the market is so competitive, producers are motivated to keep raising the standard and adding new features to their mid-range climbing shoes, which increases their appeal to customers looking for good value. Medium-priced shoes hold a considerable proportion in Italy's climbing shoe market due to their affordability, which attracts to a wider range of climbers such as students, recreational climbers, and those looking to upgrade from entry-level footwear

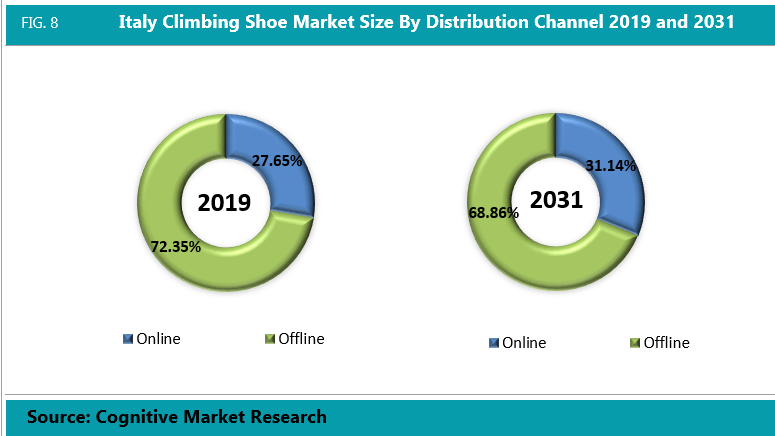

Italy Climbing Shoe Market By Distribution Channel, (2019-2031)

On the basis of distribution channel, the market was segmented into online and offline. Offline segment accounted for the significant market share of 72.35% in 2019 and will reach 68.86% in 2031. The climbing community finds a tangible and engaging buying experience in offline channels including sporting goods stores, specialty outdoor retailers, and climbing gyms. Before making a purchase, Italian climbers frequently appreciate having the chance to physically try on climbing shoes, evaluate how well they fit, and get tailored advice from experienced staff members. In addition, these physical stores frequently double as community centers where climbers gather to exchange stories, get guidance, and take part in activities and seminars, creating a feeling of community and constancy among customers. Furthermore, physical stores usually have a wide range of climbing shoes from different manufacturers, so customers can compare models and choose the one that best suits their requirements and preferences.

Despite the ease and accessibility that online channels provide, offline retailers keep gaining popularity in Italy because of the value that is placed on personal relationships, professional advice, and the whole shopping experience. This has led to their substantial market share in the Climbing Shoe Market based on distribution channels.