Introduction and the Crucial Role of the Current Market Scenario in the Aircraft Tires Industry

Safety, efficacy, and reliability are of the utmost importance in the aviation sector, where the aircraft tire industry plays a critical role. Aircraft tires are designed to endure a variety of extreme conditions, such as high speeds, hefty loads, and varying weather conditions. They are indispensable components of both military and commercial aviation, as they are crucial during launch, landing, and taxiing. The aircraft tires market is undergoing substantial growth as of 2023. It is expected to continue into 2024, which is being driven by the expansion of fleets, increased demand for air travel, and advancements in tire technology. The market's rapid evolution is being driven by the ongoing modernization of the global aircraft fleet and the introduction of new-generation aircraft with advanced features. Aircraft tires are engineered to satisfy rigorous safety and performance criteria. These tires are typically constructed from a combination of layers, such as a tread layer, sidewall, and reinforcing plies, which are all derived from rubber compounds that have been specifically formulated to ensure durability and resistance to punctures, cutting, and wear.

Cognitive Market Research predicts significant growth for the aircraft tires market in 2023 as they are required to endure temperatures ranging from -50°C to 60°C, pressures of up to 200 psi, and speeds exceeding 250 mph. In order to withstand rigorous training and combat conditions, tires for fighter jets, transport aircraft, and other military vehicles must be able to support unique requirements, including rapid accelerations and decelerations, operation on unpaved surfaces, and enhanced durability. The demand for aircraft tires is expected to increase, with the commercial aviation segment accounting for a significant portion as a result of the expanding global fleet and increasing passenger traffic, according to recent industry analyses. With over 80% of aircraft tires in the commercial sector being retreaded multiple times before replacement, retreading is becoming increasingly popular as a cost-effective and sustainable practice. The evolution of this market is expected to prioritize the enhancement of safety features, the improvement of performance, and the promotion of sustainability through practices such as retreading.

What are the current trends in the Aircraft Tires Market?

Based on the research conducted by Cognitive Market Research, the global Aircraft Tires (AOM) market is estimated to be worth approximately USD 1545.6 million as of 2024. It will grow at a CAGR of 3.2% for the upcoming years. The aircraft tires market is enduring transformative changes in 2023 and 2024 that are indicative of broader shifts in the aviation industry. The incorporation of sophisticated materials and design enhancements into tire manufacturing is one of the most notable trends. Composite materials are being used to manufacture aircraft tires, which contribute to enhanced fuel efficiency and reduced emissions by reducing weight and enhancing durability. Manufacturers have been encouraged to investigate bio-based materials and innovative production techniques that reduce waste and energy consumption in response to the aerospace sector's emphasis on environmental sustainability. Additionally, there is an increasing trend in the tire industry to incorporate digital technologies. Real-time data on tire health, such as pressure, temperature, and tread wear, is provided by smart tires that are equipped with IoT sensors. In addition to optimizing maintenance schedules, this innovation not only improves safety by preventing malfunctions but also reduces downtime and operational costs for airlines. Retreading, a procedure that involves the renewal of worn-out tires, is also gaining traction as a cost-effective and environmentally friendly solution. This procedure enables tires to be reused multiple times, thereby extending their lifespan and reducing the necessity for additional resources. Regulatory constraints and corporate responsibility commitments are driving the industry toward the adoption of such sustainable practices. Goodyear was chosen by Airbus to provide the tires for the new A321XLR, which will begin transporting passengers in 2024. One of Goodyear's most sophisticated aviation tires, the Flight Radial Tire, will be installed on the Airbus A321XLR aircraft.

The global aircraft tire market is distinguished by distinct regional dynamics, each of which is influenced by unique factors. A robust aviation infrastructure and a preponderance of major airlines and aircraft manufacturers are the driving forces behind North America's approximately 35% market share. The region has established itself as a leader in tire innovation and safety standards due to its significant emphasis on research and development. Additionally, the market's efficacy and responsiveness to fluctuations in demand are improved by the presence of well-established supply chains and distribution networks.

The aviation sector's rapid expansion is the primary factor driving the market in the Asia Pacific region, which accounts for approximately 30% of the market. Increasing middle-class populations and disposable incomes are causing a surge in aviation travel in countries such as China and India. The market is being further strengthened by the substantial investments in airport infrastructure and the aggressive expansion of low-cost carriers. The aviation industry in Europe is mature and adheres to rigorous safety and environmental regulations, as evidenced by its 25% market share. The competitive advantage of the region is emphasized by its emphasis on advanced manufacturing technologies and ecological aviation practices. The remaining 10% of the market is made up of the Rest of the World, which encompasses regions such as Africa, the Middle East, and Latin America. These regions are progressively expanding their market presence because of the expansion of their tourism sectors and economic development. Regulatory frameworks, technological adoption, and strategic partnerships between local and international companies are among the factors that influence the competitive landscape in these regions.

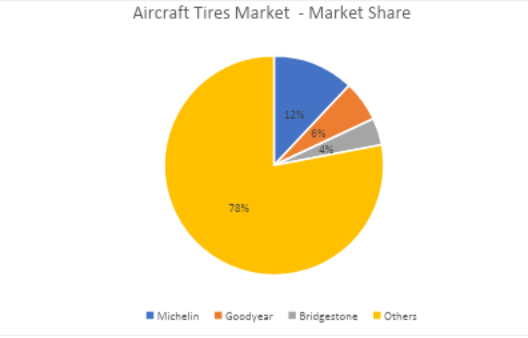

A small number of key actors dominate the aircraft tire market, significantly influencing industry trends and directions. Michelin, the market champion, currently holds approximately 12% of the global market share. The company's success is ascribed to its dedication to sustainability, quality, and innovation. Michelin is renowned for its durability and efficacy in extreme conditions, and its product line is designed to accommodate a variety of aircraft types. The company prioritizes the development of tires that adhere to the most stringent safety regulations while simultaneously mitigating its environmental impact through substantial investments in research and development. Another significant player is Goodyear, which is renowned for its exhaustive distribution network and emphasis on tire longevity and reliability. It holds a 6% market share. Goodyear's strategic partnerships with airlines and aircraft manufacturers allow it to offer customized solutions that satisfy operational needs. Bridgestone, which controls approximately 4% of the market, capitalizes on its technological expertise and global partnerships to improve its market presence. It guarantees that its products satisfy the aviation industry's evolving requirements by emphasizing innovation and quality. The influence and dominance of these top three companies are underscored by their collective 85% global market share. To preserve this position, they prioritize customer service and support, expand their global presence through partnerships and acquisitions, and maintain a consistent investment in research and development.

Higher Costs Associated with Hinder Market Growth

The high manufacturing costs associated with the production of advanced aircraft tires, particularly those that employ composite materials and innovative designs, are significant restraints that can impede the growth of the aircraft tires market. These costs have a significant impact on the profitability and sustainability of tire production, which presents a challenge for manufacturers in their efforts to offer high-performance tires at an affordable price to airlines and aircraft operators. The production of sophisticated aircraft tires necessitates the utilization of high-cost materials, including carbon fibers, aramid fibers, and specialty polymers, as well as intricate manufacturing processes. These materials are significantly more expensive than the conventional rubber and steel components used in standard aircraft tires even though they offer superior performance characteristics such as increased durability and reduced weight. For example, steel costs less than $2 per pound, while carbon fiber, a critical component of numerous composite materials, can cost between $10 and $20 per pound. This disparity directly influences the overall expense of producing composite aircraft tires in material costs.

Additionally, the manufacturing process necessitates skilled labor and specialized apparatus, in addition to material costs. To manufacture composite tires, production facilities must invest in state-of-the-art machinery and exhaustive training programs for their workforce due to the precision and technical expertise it requires. Tire manufacturers may be discouraged from expanding production or entering the market due to the increased capital expenditure associated with these investments. Additionally, the aerospace industry's rigorous safety and performance standards require extensive testing and certification procedures for new aircraft tires. These processes are both time-consuming and expensive, which augments the financial burden that manufacturers endure. The certification of a new aircraft component can cost upwards of $50 million and take anywhere from one to three years, according to a report by the Federal Aviation Administration (FAA). The cost is contingent upon the complexity and novelty of the product. Investing in new technologies can be discouraged by such financial and time commitments, particularly for smaller companies with restricted resources.

Expected Future Developments in the Aircraft Tires Market

The commercial aviation sector's robust development is anticipated to be one of the primary factors that will influence the future of the aircraft tires market. The demand for air travel is expected to increase substantially as the global economy continues to recover and expand. This will result in a need for new aircraft and, as a result, aircraft tires. Tire manufacturers have a significant opportunity to expand their market presence and innovate to satisfy the changing demands of the industry as a result of this growth. According to the International Air Transport Association (IATA), the number of passengers traveling globally is expected to surpass 8.2 billion by 2037, which is nearly double the 4.4 billion passengers that were transported in 2018. The expansion of low-cost carriers, which provide affordable travel options, and the rise in disposable incomes, particularly in emergent markets, are the primary factors driving this increase in air travel demand. It is anticipated that the Asia-Pacific region will be a significant growth driver, contributing over half of the new passenger traffic in the next two decades. The surge in demand necessitates a proportional increase in the global aircraft fleet in response to this growth in passenger traffic. Kumho Tyres (South Korea) was awarded the Red Dot Design award in Germany in September 2022 for its 'Airborne Tire', an electric tire designed for urban air mobility solutions. The tire operates on the same principle as magnetic levitation train systems. The tire offers a a viable and optimal solution for the urban air mobility sector, which is expected to experience a growth in the within the next few years.

The global commercial fleet is expected to increase from approximately 25,000 aircraft in 2020 to over 48,000 aircraft by 2040, as per Boeing's 2023 Commercial Market Outlook. The introduction of new-generation aircraft that are optimized for sustainability and efficiency is a component of this expansion. The demand for high-performance aircraft tires that can satisfy the rigorous safety, durability, and environmental standards of contemporary aviation will increase as airlines replace older, less efficient models with these newer aircraft. The future of the aircraft tire market is expected to be influenced by the ongoing trend toward sustainable aviation, in addition to fleet expansion. Airlines are placing a greater emphasis on sustainability in their operations, with a particular emphasis on the reduction of petroleum consumption and emissions. Improved aircraft fuel efficiency and reduced environmental impact of air travel can be achieved through the use of advanced aircraft tires constructed from lightweight, durable materials. The aviation industry's transition to circular economy practices will be furthered by the development of tires that can be recycled and retreaded.

Conclusion

The commercial aviation sector's expansion and the growing demand for more sustainable and efficient aviation solutions are driving the aircraft tires market to a trajectory of robust growth. The market is anticipated to experience substantial progress as the global economy continues to strengthen and air travel continues to rebound. This progress will be driven by the increasing demand for newer aircraft to accommodate the increase in passenger traffic, as well as by innovation. In 2023, Boeing's Commercial Market Outlook anticipates that the global aircraft fleet will nearly double, from approximately 25,000 aircraft in 2020 to over 48,000 by 2040. This prediction is based on statistical analysis. A substantial increase in the production and supply of aircraft tires, particularly those that are compatible with next-generation aircraft that are designed for increased fuel efficiency and reduced emissions, is required as a result of this dramatic expansion. It is anticipated that the Asia-Pacific region will be responsible for over half of the new passenger traffic by 2037, indicating a significant shift in market dynamics toward emerging markets.

The market is experiencing a transition to advanced composite materials that provide advantages such as increased durability and reduced weight in terms of technology and materials. As manufacturing processes improve and economies of scale are attained, these materials are anticipated to become more economically viable despite their current high cost. The industry's dedication to sustainability is also underscored by the transition to retreading and recycling, which is consistent with global environmental objectives and regulatory frameworks. Another promising area of development is the incorporation of smart technologies into aircraft tires. Real-time monitoring capabilities and sensors that are Internet of Things (IoT) enabled are not only improving safety and reliability but also optimizing maintenance schedules and reducing operational costs. This trend toward predictive analytics and data-driven maintenance is anticipated to gain momentum, resulting in safer and more efficient airline operations.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.