Introduction of Aerospace Adhesives Market/Industry:

The Aerospace Adhesives Market is fueled by the proliferation of the aerospace industry in emerging markets, advancements in adhesive technologies, and the growing demand for lightweight and fuel-efficient aircraft. According to Cognitive Market Research, it is valued at USD 1354.2 million in 2023; the market is projected to grow at a CAGR of 5.5%, reaching USD 2078.2 billion by 2032. The Aerospace Adhesives Market significantly influences the manufacturing and maintenance of both commercial and military aircraft. The market is experiencing growth as a result of advancements in adhesive formulations that satisfy rigorous aerospace standards, thereby reducing the overall weight of aircraft and ensuring safety and durability. Henkel AG & Co. KGaA, 3M Company, and Bostik SA are the foremost companies in the Aerospace Adhesives Market. These organizations are fiercely competitive, emphasizing strategic partnerships, acquisitions, and product innovation to fortify their market positions. North America primarily dominates the Aerospace Adhesives Market as a result of its well-established aerospace industry, significant presence of key manufacturers, and ongoing investments in advanced aerospace technologies. The region's dominance is further bolstered by the robust demand for commercial and defense aircraft, as well as favorable government policies that promote innovation and production in the aerospace sector.

Top Companies Operating in the Aerospace Adhesives Industry Worldwide

- 3M

- DuPont

- Henkel

- Bostik (Arkema)

- H.B. Fuller Company

- PPG Industries, Inc.

- Illinois Tool Works Inc.

- Master Bond Inc.

- Solvay

- Beacon Adhesives

- Scigrip Adhesives

- LORD Corporation

- Hexcel Corporation

- Permabond

- General Sealants

Criteria for Comparing Companies in the Aerospace Adhesives Market:

When comparing companies in the Aerospace Adhesives Market, Cognitive Market Research is deemed essential for assessing their competitive strength and market position. The company's capacity to create sophisticated adhesive formulations that satisfy the rigorous standards of the aerospace industry was evaluated primarily by its innovation capability. Companies that prioritized research and development (R&D) and exhibited a robust pipeline of new products were perceived as more favorable. Customer base and market reach were indispensable variables. The market position of a company was substantially determined by the scope of its distribution network and its relationships with major aerospace manufacturers, which encompassed both commercial and defense sectors. Companies that maintained robust partnerships with critical industry actors and maintained a global presence were more competitive. Diversification of the product portfolio comprised the third criterion. Companies that provided a diverse selection of adhesives that were appropriate for a variety of aerospace applications, including surface protection, sealing, and structural bonding, were deemed to have a competitive advantage. Furthermore, those that were capable of accommodating both conventional and emerging materials, such as composites and advanced metals, gained a more advantageous position in the market. Fourth, financial performance was a critical metric, with a focus on revenue growth, profitability, and investment capacity. Companies that maintained consistent revenue streams from aerospace adhesives and maintained healthy profit margins were perceived as more stable and capable of sustaining long-term growth. Companies that prioritized sustainable practices in their manufacturing processes and manufactured adhesives that complied with international regulations, including RoHS and REACH, were regarded as market leaders. The competitive advantage and market leadership of companies in the Aerospace Adhesives Market were determined by their commitment to sustainability and regulatory compliance, financial health, product portfolio diversification, market reach, and innovation capabilities. In conclusion, these factors were compared.

Top Manufacturing Companies of Aerospace Adhesives:

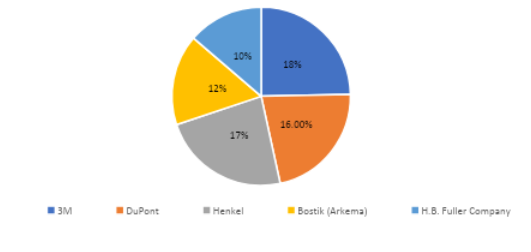

3M, DuPont, Henkel, Bostik (Arkema), and H.B. Fuller Company are the key players in the Aerospace Adhesives Market.

3M

3M, a Minnesota-based global science and technology corporation, was established in 1902. It is engaged in a variety of industries, such as health care, safety, consumer products, and industrial solutions, with an emphasis on sustainable solutions and innovation. Through its innovative adhesive technologies that are designed for durability and efficacy, 3M has become a market leader in aerospace adhesives.

DuPont:

Specializing in science-based solutions for a variety of industries, such as agriculture, electronics, transportation, and construction, DuPont, which was established in 1802, is a diversified global company. DuPont's history of innovation has earned it a solid reputation for the development of specialty compounds and high-performance materials. DuPont is a prominent participant in the aerospace adhesives sector, providing cutting-edge adhesive solutions that improve the safety and performance of aircraft.

Henkel

Henkel, a multinational corporation headquartered in Düsseldorf, Germany, was established in 1876. The company is renowned for its leadership in the industrial and consumer sectors. The organization conducts business in three sectors: Beauty Care, Adhesive Technologies, and Laundry & Home Care. Henkel's Adhesive Technologies division is a global champion in the provision of a diverse selection of adhesive solutions for the aerospace industry.

Bostik

Bostik, a global adhesive specialist with over a century of experience in the development of smart adhesive solutions for a variety of industries, including construction, automotive, and aerospace, is a subsidiary of Arkema. This company was established in 2004. Arkema, a global leader in specialty chemicals, is headquartered in France. Bostik has become a significant participant in the aerospace adhesives market, operating under Arkema's umbrella.

H.B. Fuller Company

Founded in 1887, H.B. Fuller Company is a global adhesive manufacturer with its headquarters in Minnesota, USA. The company is renowned for its innovative bonding, sealing, and coating solutions, which are used in a variety of industries, such as construction, electronics, and transportation. H.B. Fuller is a substantial participant in the aerospace adhesives market, offering high-performance adhesive solutions that meet the rigorous requirements of the aerospace industry.

Potential Threats to Top Five Players in the Aerospace Adhesives Market:

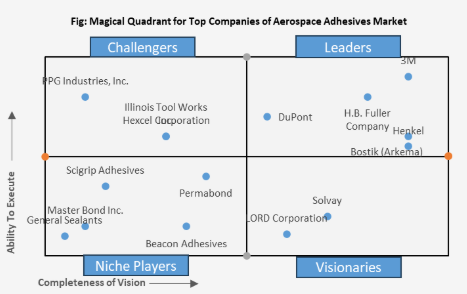

CMR found that emerging players in the Aerospace Adhesives market, such as PPG Industries, Inc., Illinois Tool Works Inc., Solvay, and Hexcel Corporation, are poised to become significant threats to the top five companies. The robust innovation capabilities and extensive global reach of PPG Industries present a threat to dominant entities. Their expertise in aerospace coatings enables them to expand into adhesives, capitalizing on synergies effortlessly. Their dedication to sustainability and research and development investments can result in cutting-edge products that pose a challenge to the current market leaders. The competitive pressure is further exacerbated by PPG's aggressive expansion strategy in emergent markets. Illinois Tool Works (ITW) has a robust financial foundation to expand into aerospace adhesives, as it has a diversified portfolio across multiple industries. Their demonstrated capacity to optimize manufacturing processes and innovate provides them with an advantage in the introduction of cost-effective solutions. With an emphasis on strategic acquisitions, ITW has the potential to rapidly expand in the aerospace adhesives sector, posing a significant challenge to the current market leaders. Solvay is a formidable competitor in the aerospace adhesives industry due to its proficiency in sophisticated materials and specialty chemicals. Their emphasis on sustainable and high-performance materials is well-suited to the aerospace industry's requirements. Solvay's strategic partnerships and investments in research and development have the potential to facilitate the development of next-generation adhesives that challenge existing market leaders and disrupt the market. Hexcel is a prominent participant in the aerospace industry, with a particular emphasis on advanced composites. Their strong R&D capabilities, combined with their profound comprehension of composite materials, enable them to pioneer in the field of aerospace adhesives. Hexcel's established relationships with major aerospace manufacturers could enable them to rapidly capture market share, thereby presenting a substantial threat to the current dominant companies.

Conclusion

They are widening the demand for lightweight and fuel-effective aircraft to enhance the growth of the Aerospace Adhesives Market.

The market, valued at USD 1354.2 million in 2023, is projected to reach USD 2078.2 million by 2032, driven by increasing demand for lightweight and fuel-efficient aircraft, advancements in adhesive technologies, and the growing aerospace industry in emerging markets. The Aerospace Adhesives Market is undergoing substantial growth because of the increasing demand for lightweight materials, the increasing production of aircraft, and advancements in aerospace technologies. This market includes a wide variety of adhesives, including specialty adhesives, non-structural adhesives, and structural adhesives, all of which are specifically engineered to satisfy the specific needs of the aerospace industry, including resistance to extreme conditions, durability, and high strength. The market is distinguished by a high level of competition among the major participants, with an emphasis on strategic collaborations, sustainability, and innovation. Due to numerous factors, the top five dominant players—3M, DuPont, Henkel, Bostik (Arkema), and H.B. Fuller Company—continue to maintain their top positions. 3M is a market leader due to its extensive product portfolio, strong brand reputation, and ongoing innovation. DuPont's global presence, in conjunction with its proficiency in sophisticated materials and chemicals, serves to reinforce its position as a leader. Henkel's leadership is a result of his dedication to sustainability and its strong R&D capabilities, which enable the company to provide high-performance adhesives. Bostik (Arkema) exploits its strong global distribution network and specialization in specialty adhesives, while H.B. Fuller Company maintains its competitive edge by emphasizing technological advancements and customer-centric solutions. These companies capitalize on their substantial financial resources, long-standing industry presence, and capacity to innovate in response to changing market demands.

PPG Industries, Inc., Illinois Tool Works Inc., Solvay, and Hexcel Corporation, are among the emerging players that are advancing in the industry by concentrating on niche markets and capitalizing on their expertise in related disciplines. Due to its extensive experience in aerospace coatings, PPG Industries is currently expanding into adhesives through sustainability initiatives and innovation. Illinois Tool Works Inc. capitalizes on its strategic acquisitions and diversified business model to facilitate accelerated market penetration. Solvay is a significant competitor due to its emphasis on sustainable materials and specialty compounds. Hexcel Corporation's technical expertise in advanced composites enables it to create high-performance adhesives. The Aerospace Adhesives Market is characterized by a dynamic interplay between established leaders and emerging challengers in its competitive landscape. Emerging players are gaining ground by addressing market gaps, embracing sustainability, and leveraging strategic partnerships, while dominant players continue to lead through innovation, scale, and strong customer relationships. The market is expected to experience additional consolidation, technological advancements, and a heightened emphasis on environmentally favorable solutions as competition intensifies.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.