Introduction of VOCs Sensors Market / Industry:

The VOCs (Volatile Organic Compounds) sensors market is experiencing steady growth, driven by rising concerns over air quality monitoring, industrial safety, and regulatory compliance. According to Cognitive Market Research, the market is valued at USD 156.6 million in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 6.00%, reaching USD 249.6 million by 2032. VOC sensors play a crucial role in detecting hazardous airborne compounds emitted from industrial processes, vehicle emissions, consumer products, and indoor environments. With growing awareness of environmental pollution and the need for stringent air quality regulations, industries such as healthcare, automotive, building automation, and oil & gas are increasingly integrating VOC sensors into their monitoring systems. The demand for compact, energy-efficient, and highly sensitive sensors is accelerating innovation in sensor technologies, including photoionization detectors (PID), metal oxide semiconductor (MOS) sensors, and infrared (NDIR) sensors. The adoption of smart sensor networks, IoT-enabled monitoring solutions, and real-time air quality analytics is further fueling market growth. The Asia-Pacific region, led by rapid urbanization, industrial expansion, and stricter environmental policies in China, India, and Japan, is emerging as a major growth hub. Meanwhile, North America and Europe remain key markets due to stringent air quality standards and the increasing use of VOC sensors in smart homes, HVAC systems, and industrial safety applications. As the market evolves, advancements in miniaturized, wireless, and AI-powered VOC detection technologies will reshape competitive dynamics. Companies that align their strategies with sustainability, technological innovation, and regulatory compliance will drive the future of the VOCs sensors industry.

Top Companies Operating in the VOCs Sensors Industry Worldwide

Honeywell International Inc.

Siemens AG

ABB Ltd.

Bosch Sensortec GmbH

Sensirion AG

Renesas Electronics Corporation

Alphasense

SGX Sensortech

lon Science Ltd.

EcoSensors

Criteria for Comparing Companies in the VOCs Sensors Market:

Cognitive Market Research has assessed companies in the VOCs sensors market using key parameters that emphasize their competitive positioning and performance within the industry. Revenue and market share serve as primary indicators of a company's financial health and market leadership. A higher revenue reflects strong sales performance, underscoring the high demand for the company's offerings in a competitive marketplace. The product portfolio of each company is evaluated based on the variety and quality of VOC sensors they offer, including PID, MOS, and NDIR sensor types. Detailed attention is given to product features such as detection sensitivity, response time, power efficiency, sensor lifespan, and compatibility with specific applications such as industrial air monitoring, smart home automation, and vehicle emissions control. Companies excelling in developing high-precision, low-power, and IoT-compatible sensors gain a competitive edge. Technological innovations and product characteristics are critical in assessing a company's ability to meet evolving industry standards. Firms investing in advanced semiconductor materials, AI-driven data processing, and wireless connectivity for real-time monitoring demonstrate their capacity for innovation. Companies offering tailored solutions for emerging trends, such as VOC detection in electric vehicles (EVs), wearable air quality monitors, and building automation systems, stand out. Another crucial factor is global presence, reflecting a company's capability to serve diverse markets effectively and maintain a strong customer base across regions. Firms with extensive distribution networks and strategic partnerships in key growth markets such as Asia-Pacific and North America are better positioned to capitalize on regional opportunities. Investment in research and development (R&D) highlights a company's commitment to innovation and adaptability to changing market demands. Companies with significant R&D expenditures often lead in developing next-generation VOC sensors with improved selectivity, miniaturization, and real-time analytics capabilities. Additionally, strategic alliances and collaborations with end-user industries, such as automotive manufacturers, industrial automation firms, and environmental monitoring agencies, are essential for expanding market reach and improving product offerings. Partnerships with smart city developers and IoT solution providers further enhance competitive positioning. Analyzing companies based on these parameters provides a comprehensive understanding of their strengths, competitive advantages, and growth potential in the dynamic VOCs sensors market. Businesses prioritizing technological advancements, regulatory compliance, and sustainable innovation are best positioned to thrive in this evolving landscape

Top Manufacturing Companies of VOCs Sensors:

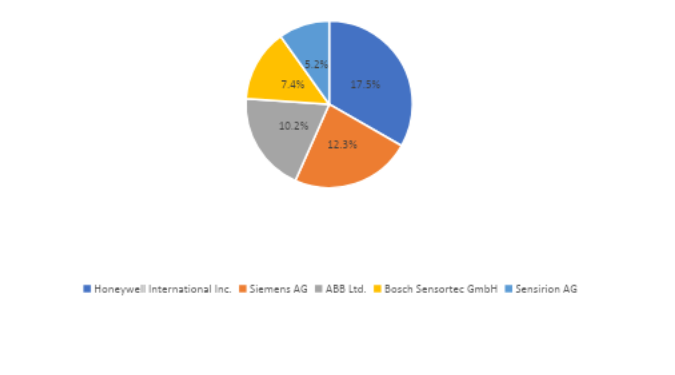

Honeywell International Inc., Siemens AG, ABB Ltd., Bosch Sensortec GmbH, and Sensirion AG. are the key players in the VOCs Sensors Market

Honeywell International Inc.

Honeywell International Inc. is a leading player in the global VOCs (Volatile Organic Compounds) sensors market, recognized for its advanced sensing technologies and extensive industrial expertise. With a market share of 17.5%, Honeywell dominates the segment by offering high-precision gas detection solutions that cater to various industries, including automotive, healthcare, environmental monitoring, and smart buildings.

Siemens AG

Siemens AG holds a significant 12.3% share in the VOCs sensors market, leveraging its expertise in industrial automation, smart infrastructure, and environmental monitoring. The company's advanced VOC sensors are widely used in air purification systems, HVAC controls, and industrial safety applications. Siemens' sensor technology integrates high-performance semiconductor-based detection mechanisms that enable real-time VOC monitoring with superior accuracy and energy efficiency.

ABB Ltd.

ABB Ltd. commands a 10.2% market share in the VOCs sensors segment, distinguished by its strong focus on industrial automation, environmental compliance, and digital monitoring technologies. The company’s VOC sensors are widely deployed in chemical processing plants, oil and gas facilities, and industrial manufacturing environments, where real-time gas detection is critical for safety and operational efficiency.

Bosch Sensortec GmbH

Bosch Sensortec GmbH, with a market share of 7.4%, is a key innovator in MEMS-based sensing solutions, particularly in the consumer electronics and smart home sectors. The company's VOC sensors are integrated into air purifiers, wearable devices, and smart home automation systems, providing real-time air quality monitoring for enhanced user experience.

Sensirion AG

Sensirion AG, holding a 5.2% share of the VOCs sensors market, is a leading developer of high-precision environmental sensing solutions. The company specializes in producing highly sensitive gas sensors that offer real-time detection of volatile organic compounds for applications in automotive, industrial, and smart building sectors.

Potential Threats to Top Players in the VOCs Sensors Market:

Emerging players in the VOCs (Volatile Organic Compounds) sensors market, such as Renesas Electronics Corporation, Alphasense, SGX Sensortech, Ion Science Ltd., and EcoSensors, are positioning themselves as significant threats to the dominance of established industry leaders. These companies are leveraging technological advancements, regional expansions, and strategic collaborations to carve out a competitive edge and challenge market incumbents. Renesas Electronics Corporation, a leading semiconductor manufacturer, has been expanding its footprint in the VOCs sensors market through its expertise in sensor integration and IoT applications. The company’s advanced semiconductor technology enables the development of highly accurate and energy-efficient VOCs sensors, making them suitable for applications in smart homes, industrial environments, and automotive sectors. Renesas has been focusing on R&D to enhance sensor miniaturization and improve sensitivity, aligning with the growing demand for high-performance air quality monitoring solutions. Alphasense, a UK-based sensor manufacturer, specializes in gas detection solutions, including VOCs sensors for industrial safety, environmental monitoring, and indoor air quality applications. The company is known for its high-sensitivity electrochemical and photoionization detection (PID) sensors, which offer reliable real-time monitoring of VOC concentrations. Recent investments in expanding its product portfolio and forming strategic partnerships with industrial equipment manufacturers have strengthened its competitive position, particularly in Europe and North America. SGX Sensortech, headquartered in Switzerland, is gaining traction with its innovative metal oxide semiconductor (MOS) and infrared VOCs sensors. The company has been expanding its market presence by focusing on smart city applications, automotive cabin air quality monitoring, and industrial safety solutions. SGX Sensortech’s emphasis on developing highly selective and long-lasting VOCs sensors makes it a strong contender against established players. Its collaborations with automotive manufacturers and HVAC system providers are further enhancing its global footprint.

Ion Science Ltd. has established itself as a key player in the VOCs sensors market by specializing in photoionization detection (PID) technology. The company’s sensors are widely used in industrial environments, environmental monitoring, and health and safety applications. Ion Science’s strong focus on innovation and continuous improvements in sensor durability and response time have given it a competitive edge. Its global expansion strategy, including a stronger presence in North America and Asia-Pacific, is helping it challenge leading sensor manufacturers. EcoSensors, a company known for its cost-effective and compact VOCs detection solutions, is emerging as a competitive force in air quality monitoring for residential and commercial applications. Its sensors are designed for easy integration into consumer electronics, HVAC systems, and industrial monitoring equipment. By offering high-performance sensors at competitive prices, EcoSensors is positioning itself as a strong alternative to premium sensor manufacturers. Its focus on developing low-power, energy-efficient VOCs sensors aligns with the growing demand for sustainable and smart air quality solutions. These emerging companies are disrupting the market through technological advancements, cost efficiency, sustainability initiatives, and regional expansions. As they continue to innovate, increase production capacities, and establish strategic partnerships, they pose a growing threat to the established leaders in the VOCs sensors market.

Conclusion:

Focus on R&D Capabilities and Product Diversification to Drive Growth in the VOCs Sensors Market

The VOCs sensors market is experiencing rapid transformation, with significant growth potential driven by the increasing need for air quality monitoring across various industries. Valued at USD 156.6 million in 2024, the market is projected to reach USD 249.6 million by 2032, expanding at a CAGR of 6.00%. Key factors fueling this growth include rising environmental regulations, growing awareness of indoor air quality, and advancements in sensor technology. The competitive landscape of the VOCs sensors market is shaped by a mix of established players and emerging innovators. Leading companies benefit from strong R&D investments, diverse product portfolios, and extensive distribution networks. These players continue to develop high-performance sensors for smart cities, industrial safety, and consumer electronics applications. To stay ahead, companies must balance innovation with cost efficiency, expand their sensor offerings, and adapt to emerging trends such as IoT integration and sustainability. The ability to invest in R&D and diversify product portfolios focusing on highly sensitive, low-power, and eco-friendly VOCs sensors will be crucial for maintaining a competitive edge. As demand for real-time air quality monitoring solutions continues to rise, the VOCs sensors market will offer significant opportunities for companies that prioritize technological advancements, strategic partnerships, and global expansion.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.