Introduction to the Thermal Power Plant Market

The Thermal Power Plant market remains a crucial pillar of global energy production, driven by rising electricity demand, expanding industrialization, and ongoing advancements in power generation technologies. According to Cognitive Market Research, the market is valued at USD 1,482,142.5 million in 2024 and is projected to grow at a CAGR of 4.00%, reaching USD 2,028,414.4 million by 2032. Thermal power plants, which primarily rely on coal, natural gas, and oil as fuel sources, continue to play a significant role in meeting global energy needs, despite the increasing shift toward renewable alternatives. The market's growth is influenced by factors such as the modernization of aging power infrastructure, increased investments in energy security, and the development of cleaner and more efficient thermal power generation technologies.

Governments and energy companies worldwide are focusing on enhancing the efficiency and sustainability of thermal power plants by integrating advanced emission control technologies, carbon capture and storage (CCS) solutions, and higher-efficiency turbines. The transition from conventional coal-fired plants to cleaner alternatives such as natural gas-based power generation is gaining traction, particularly in regions like North America and Europe. Meanwhile, emerging economies in Asia-Pacific, including China and India, are witnessing substantial investments in thermal power infrastructure to meet the rising electricity demands of their rapidly growing populations and industrial sectors. Additionally, the integration of digitalization, automation, and smart grid technologies is improving plant

performance, optimizing resource utilization, and reducing environmental impact.

Criteria for Comparing Companies in the Thermal Power Plant Market

Cognitive Market Research evaluates companies in the Thermal Power Plant market based on several key criteria that define their competitive positioning, technological advancements, and overall market influence. Revenue and market share serve as primary indicators of a company’s financial strength and its ability to maintain long-term stability in the evolving energy landscape. Companies with higher revenues demonstrate robust operational capacity, strong government partnerships, and the ability to undertake large-scale power generation projects. Technological innovation is another critical parameter in assessing market leaders. Companies that invest in high-efficiency supercritical and ultra-supercritical steam turbines, combined cycle gas turbines (CCGT), and advanced emission reduction technologies are better positioned to meet environmental regulations and enhance power plant efficiency. The shift toward digitalization, including artificial intelligence-driven predictive maintenance and real-time monitoring systems, is also a key differentiator in optimizing plant operations and minimizing downtime. Additionally, the adoption of carbon capture and storage (CCS) solutions is becoming increasingly important for companies looking to align with global sustainability goals while maintaining profitability.

Geographical presence is another significant factor, as companies operating in high-growth regions with increasing energy demand, such as Asia-Pacific, the Middle East, and Africa, have greater opportunities for expansion. Establishing strategic partnerships with government agencies, infrastructure developers, and energy regulators provides a competitive edge by ensuring long-term contracts and favorable regulatory support. Investment in research and development (R&D) further highlights a company’s commitment to advancing thermal power generation technologies, improving fuel efficiency, and minimizing greenhouse gas emissions. Market leaders in the Thermal Power Plant sector distinguish themselves through their expertise in large-scale project execution, integration of advanced technologies, and alignment with global energy transition trends. As the industry moves toward more sustainable and efficient power generation methods, companies that prioritize cleaner technologies, digital transformation, and strategic collaborations will maintain a strong foothold in this evolving market. The increasing need for reliable and cost-effective power solutions, coupled with continued government and private sector investments, ensures that thermal power plants will remain a key component of the global energy mix in the foreseeable future.

Top Companies Operating in the Thermal Power Plant Industry Worldwide

- China Huaneng Group Co. Ltd.

- Duke Energy Corporation

- Tenaga Nasional Berhad

- Eskom Holdings SOC Ltd.

- Dominion Energy Solutions Inc.

- NTPC Limited

- RWE Aktiengesellschaft

- Jindal India Thermal Power Limited

- American Electric Power Company

- China National Petroleum Corporation (CNPC)

Top Manufacturing Companies of Thermal Power Plant:

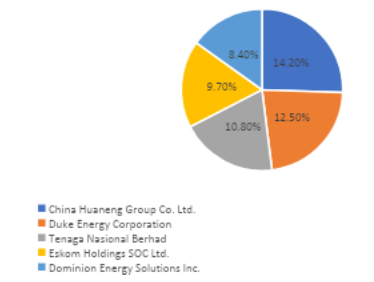

China Huaneng Group Co. Ltd., Duke Energy Corporation, Tenaga Nasional Berhad, Eskom Holdings SOC Ltd., and Dominion Energy Solutions Inc. are the key players in the Thermal Power Plant Market

China Huaneng Group Co. Ltd.

China Huaneng Group Co. Ltd. leads the global thermal power plant market, commanding a 14.2% market share. As China’s largest power generation company, it plays a crucial role in meeting the country’s massive energy demands. The company operates coal-fired, gas-fired, and combined-cycle thermal power plants, with an installed capacity exceeding 220 GW. In 2023, China Huaneng generated an estimated USD 63.5 billion in revenue from its thermal power operations, underscoring its dominance in the sector.

Duke Energy Corporation

Duke Energy Corporation, a major U.S.-based power company, holds a 12.5% market share in the global thermal power plant sector. The company operates coal, gas, and oil-fired power plants, with a total generation capacity of approximately 58 GW across the United States. In 2023, Duke Energy’s thermal power segment contributed approximately USD 27.4 billion in revenue, making it one of the largest power producers in North America.

Tenaga Nasional Berhad (TNB)

Malaysia’s Tenaga Nasional Berhad (TNB) is a leading player in the thermal power plant market, holding a 10.8% share. As Malaysia’s largest electricity utility, TNB operates a diverse portfolio of coal, natural gas, and oil-fired power plants, with a total installed capacity of over 33 GW. In 2023, TNB’s thermal power business generated approximately USD 18.2 billion in revenue, reinforcing its position as a dominant force in Southeast Asia’s power sector.

Eskom Holdings SOC Ltd.

Eskom Holdings SOC Ltd., South Africa’s state-owned power utility, holds a 9.7% share of the global thermal power market, primarily through its extensive fleet of coal-fired power stations. The company accounts for over 80% of South Africa’s electricity generation, with an installed thermal capacity exceeding 45 GW. In 2023, Eskom’s thermal power operations generated an estimated USD 14.6 billion in revenue, despite operational challenges and ongoing financial constraints.

Dominion Energy Solutions Inc.

Dominion Energy Solutions Inc., a leading U.S. power utility, commands an 8.4% share of the thermal power plant market. The company operates coal, oil, and natural gas-fired power plants, with a total capacity of approximately 30 GW across the United States. In 2023, Dominion Energy’s thermal power division contributed around USD 11.9 billion in revenue, reinforcing its strong market position.

Potential Threats to Top Five Players in the Thermal Power Plant Market

CMR found that the thermal power plant market is becoming increasingly competitive, with emerging players steadily challenging the dominance of industry leaders such as NTPC Limited, RWE Aktiengesellschaft, Jindal India Thermal Power Limited, American Electric Power Company, and China National Petroleum Corporation (CNPC). These established companies have long held a strong presence in the market, backed by extensive infrastructure, government contracts, and large-scale power generation capabilities. However, new entrants, including Adani Power, Tata Power, KEPCO, Chubu Electric Power, and Engie, are intensifying the competition by investing in advanced efficiency solutions, cleaner coal technologies, and strategic regional expansion. With growing global concerns over carbon emissions and the transition toward greener energy sources, these new players are capitalizing on regulatory shifts and technological innovations to position themselves as strong competitors in the thermal power sector. By integrating ultra-supercritical technology, exploring hybrid energy solutions, and enhancing fuel efficiency, emerging companies are successfully reducing operational costs while complying with stringent environmental regulations, making them a direct threat to established market leaders.

Adani Power, a key emerging player from India, is aggressively expanding its capacity, investing in state-of-the-art ultra-supercritical thermal power plants to improve efficiency while reducing emissions. With a focus on technological advancements and large-scale project execution, the company is securing long-term power purchase agreements, giving it financial stability and a competitive edge. Similarly, KEPCO, based in South Korea, is leveraging digitalization and smart grid solutions to optimize thermal power generation, enabling predictive maintenance and minimizing operational inefficiencies. Meanwhile, companies like Engie and Chubu Electric Power are diversifying their portfolios by integrating carbon capture technologies and hybrid thermal-renewable solutions, catering to the shifting demands of policymakers and consumers. These strategic moves, coupled with government incentives supporting cleaner energy initiatives, pose a growing challenge for market leaders, who must now accelerate their innovation efforts to maintain their dominance.

Conclusion

Investments in Innovation, Sustainability, and Regional Expansion are Essential for Long-Term Success in the Thermal Power Plant Market

The thermal power plant market is undergoing a transformation, with sustainability and efficiency at the core of future growth. Established companies face increasing pressure to adapt to cleaner energy standards while maintaining operational profitability. As new players enter the market, they must balance innovation with compliance, focusing on high-efficiency power generation methods and digital solutions that enhance plant performance. Additionally, leveraging partnerships with governments, investors, and technology firms will be critical for securing long-term market positioning.

For sustained growth in the thermal power plant market, companies must prioritize investments in technological advancements, sustainable energy integration, and strategic regional expansions. Investing in next-generation ultra-supercritical coal plants, carbon-neutral solutions, and hybrid energy systems can provide a competitive edge. Furthermore, exploring opportunities in emerging economies where industrialization is fueling energy demand can drive long-term profitability. Companies that adapt to evolving regulatory landscapes, embrace digitalization, and commit to sustainable practices will be best positioned to thrive in an industry that is becoming increasingly complex and competitive.

Author's Detail:

Ketaki Bhosale /

LinkedIn

I'm Ketaki Bhosale, passionate about uncovering the consumer insights and trends within the company. Skilled in designing and executing research methodologies to strive the strategic business decisions. As a part of research team, I am actively proficient in data analysis and interpretation with a keen eye for detail and commitment to delivering actionable recommendations.

My expertise lies in crafting and executing comprehensive research methodologies tailored to the unique needs of market research across various sectors. I am adept at leveraging a wide range of research techniques to gather valuable insights