Introduction to the Mobile Card Reader Market

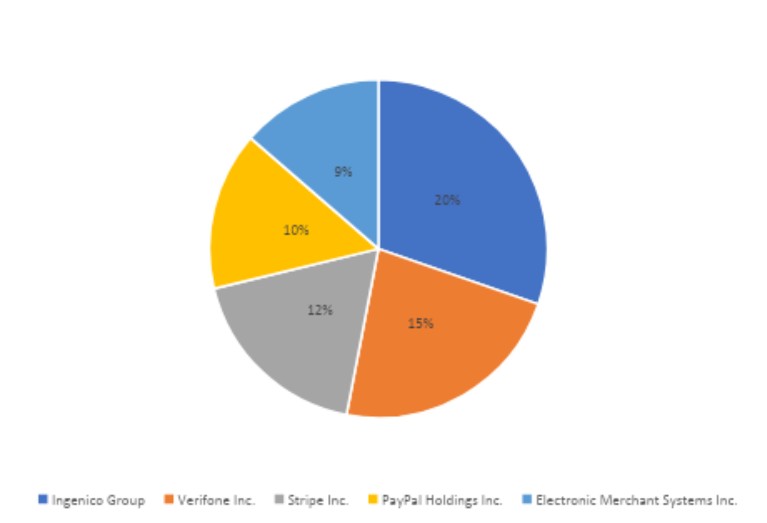

The mobile card reader market is experiencing significant expansion, driven by the global shift toward cashless transactions, growing e-commerce adoption, and advancements in payment technologies. According to Cognitive Market Research, the market is valued at USD 10.21 billion in 2024 and is projected to grow at a robust CAGR of 15.2%, reaching USD 31.68 billion by 2032. Mobile card readers, which enable secure, on-the-go payment processing via smartphones and tablets, are essential for businesses seeking to streamline operations and enhance customer convenience. Key factors fueling growth include the increasing penetration of smartphones, the rising preference for digital payments, and government initiatives promoting cashless economies. Businesses, particularly small and medium enterprises, are rapidly adopting mobile card readers to reduce dependency on traditional POS systems and leverage seamless, flexible payment solutions. Industry leaders such as Ingenico Group, Verifone Inc., Stripe Inc., PayPal Holdings Inc., and Electronic Merchant Systems Inc. are at the forefront of innovation, developing highly secure, compact, and user-friendly devices. These companies invest substantially in R&D to introduce advanced features like contactless payments, biometric authentication, and integration with digital wallets, catering to diverse customer needs. The Asia-Pacific region is emerging as a pivotal market due to rapid digitalization, a burgeoning e-commerce sector, and the growing adoption of financial technologies in countries such as China, India, and Southeast Asia. Meanwhile, North America and Europe remain key contributors due to their advanced technological infrastructure and strong regulatory frameworks supporting digital transactions. As mobile card reader technologies evolve, companies that focus on affordability, security, and user experience are well-positioned to capture market share in this rapidly growing industry.

Top Companies Operating in the Mobile Card Reader Industry Worldwide

- Ingenico Group

- Verifone Inc.

- Stripe Inc.

- PayPal Holdings Inc.

- Electronic Merchant Systems Inc.

- Advanced Card Systems Ltd.

- Revolut

- Ezetap Mobile Solutions Private Limited

- Mswipe Technologies Pvt. Ltd.

- Clover Go

- SumUp

- PayAnywhere LLC

- LifePay ZAO

- Miura Systems Limited

- Payleven Holding GmbH

Criteria for Comparing Companies in the Mobile Card Reader Market

Cognitive Market Research evaluates companies in the mobile card reader market based on key factors that highlight their competitive positioning and performance within the industry. Revenue and market share serve as critical indicators of financial stability and market leadership. A higher revenue signifies robust sales performance, reflecting strong customer demand for a company's products and services. The product portfolio is another essential parameter, with an emphasis on the variety of mobile card readers offered, including contactless devices, chip-and-pin readers, and integrated payment solutions. Detailed comparisons of the features and functionalities of these products allow for a niche-level analysis of the market. Technological innovation plays a pivotal role in assessing a company's ability to drive industry advancement. Firms that deliver secure, user-friendly, and cutting-edge solutions, such as contactless payments and biometric authentication, distinguish themselves as leaders in the market. Global presence is another vital factor, as it demonstrates a company’s capability to cater to diverse markets and establish a broad customer base. Companies with a strong global footprint are better positioned to capitalize on opportunities for international expansion. Investment in research and development (R&D) further reflects a company's commitment to innovation and its ability to stay ahead in the rapidly evolving payments landscape. High R&D expenditure often results in the launch of advanced products that strengthen competitive positioning. Strategic partnerships and collaborations with banks, financial institutions, and e-commerce platforms are instrumental in enhancing market reach and broadening product offerings. Companies that establish such alliances can expand their customer base and integrate value-added services into their solutions. By analyzing companies through these parameters, a comprehensive understanding of their strengths, competitive advantages, and growth potential in the mobile card reader market can be achieved.

Top Manufacturing Companies of Mobile Card Reader Market:

Ingenico Group, Verifone Inc., Stripe Inc., PayPal Holdings Inc., and Electronic Merchant Systems Inc. are the key players in the Mobile Card Reader Market

Ingenico Group

Ingenico Group, a global leader in payment solutions, holds a significant position in the mobile card reader market. In 2023, the company reported total revenue of approximately USD 3.38 billion, with USD 1.4 billion generated from its mobile card reader segment, capturing a robust 13.7% market share. Ingenico's innovative payment solutions are trusted worldwide, providing seamless and secure transactions for businesses of all sizes.

Verifone Inc.

Verifone Inc., a prominent player in payment solutions, excels in delivering advanced mobile card readers that enable secure and efficient payment processing. The company reported USD 980 million attributed to its mobile card reader segment, representing a 9.6% market share. Verifone’s mPOS devices support multi-channel payment options, including contactless, QR codes, and NFC-based transactions, making them highly versatile.

Stripe Inc.

Stripe Inc., a leading financial technology company, has made significant strides in the mobile card reader market. Stripe’s mobile card readers are known for their seamless integration with its payment processing platform, allowing businesses to manage online and offline payments through a single interface. The Stripe Terminal product line supports EMV, NFC, and contactless payments, catering to the evolving needs of modern merchants.

PayPal Holdings Inc.

PayPal Holdings Inc., a pioneer in digital payments, has established a strong foothold in the mobile card reader market with its "Zettle by PayPal" product line. In 2023, PayPal reported total revenue of USD 27 billion, with USD 1.2 billion attributed to its mobile card reader business, securing an 11.7% market share. The Zettle mobile card readers are designed for small and medium-sized businesses, offering compatibility with various payment methods, including contactless, chip, and swipe.

Electronic Merchant Systems Inc.

Electronic Merchant Systems (EMS) Inc. is a prominent provider of payment solutions, including advanced mobile card readers tailored for small and mid-sized businesses. EMS's mobile card readers support a variety of payment methods, such as EMV, NFC, and magnetic stripe, providing flexibility and convenience for merchants. The company focuses on delivering user-friendly, cost-effective solutions designed to enhance business efficiency. In recent developments, EMS introduced its proprietary mobile payment app, enabling merchants to monitor transactions and manage inventories in real time.

Potential Threats to Top Five Players in the Mobile Card Reader Market:

CMR found emerging players in the mobile card reader market, such as SumUp, PayAnywhere LLC, LifePay ZAO, Miura Systems Limited, and Payleven Holding GmbH, are poised to present significant challenges to the top players. SumUp, a London-based company, has established itself with its compact and affordable mobile card readers, offering easy integration with smartphones and tablets. Their rapid expansion into international markets, particularly in Europe and Latin America, positions them as a strong contender, while their focus on small business solutions and low transaction fees appeals to a wide customer base. PayAnywhere LLC, based in the USA, also poses a threat with its competitive pricing and versatile product range, which includes support for mobile payments, EMV chips, and contactless transactions. Their emphasis on affordability and user-friendly solutions has allowed them to rapidly gain traction among small and medium-sized businesses.

LifePay ZAO, headquartered in Russia, has quickly grown in Eastern Europe and other emerging markets, offering tailored mobile card reader solutions with a focus on security and transaction speed. Their commitment to providing robust and low-cost solutions gives them a competitive edge in cost-sensitive markets. Miura Systems Limited, based in the UK, has been innovating with its modular card readers that allow businesses to customize their payment solutions, targeting both small businesses and large enterprises. With recent investments in R&D and expanding into global markets, Miura's products are gaining attention for their flexibility and advanced technology. Lastly, Payleven Holding GmbH, operating across several European countries, offers affordable mobile payment solutions and has invested in customer support and merchant services. Their strong presence in Europe and focus on ease of use and scalability make them a formidable competitor. With these companies investing heavily in innovation, strategic partnerships, and regional expansion, they are well-positioned to challenge the dominance of the established leaders in the mobile card reader market.

Conclusion

R&D Focus and Product Portfolio Expansion to Drive Growth in the Mobile Card Reader Market

The mobile card reader market is poised for significant growth, driven by the increasing shift towards cashless transactions, expanding digital payment ecosystems, and evolving consumer preferences for mobile payment solutions. With the market projected to grow from USD 10.21 billion in 2023 to over USD 31.68 billion by 2032, this growth presents both challenges and opportunities for key industry players. The competitive landscape reflects a mix of consolidation, with major players such as Ingenico Group, Verifone Inc., Stripe Inc., PayPal Holdings Inc., and Electronic Merchant Systems Inc. dominating market share through extensive R&D efforts, comprehensive product portfolios, and global reach. These companies focus on innovation, such as providing end-to-end mobile payment solutions, advanced encryption technologies, and integration with various point-of-sale systems to cater to a diverse range of industries and payment preferences. Their substantial investments in security features and customer support are helping them maintain strong positions in the market.

At the same time, emerging companies such as SumUp, PayAnywhere LLC, and LifePay ZAO are challenging the dominance of established players through disruptive innovation, affordable solutions, and targeted regional expansions. These companies focus on cost-effective card readers, customizable solutions, and simplified payment processes, particularly for small and medium-sized businesses in emerging markets. With growing adoption of mobile payments in regions like Southeast Asia, Eastern Europe, and Latin America, these players are well-positioned to capture market share through localized strategies and technological advancements. The mobile card reader market is characterized by a blend of consolidation at the top and rising competition from agile innovators. The competition is fierce, with both established firms and emerging players leveraging technology, cost-efficiency, and strategic expansion to secure their positions. Companies that can continue to drive innovation, improve payment security, and expand their global presence will be well-positioned for success in this rapidly evolving market.

Author's Detail:

Kalyani Raje /

LinkedIn

With a work experience of over 10+ years in the market research and strategy development. I have worked with diverse industries, including FMCG, IT, Telecom, Automotive, Electronics and many others. I also work closely with other departments such as sales, product development, and marketing to understand customer needs and preferences, and develop strategies to meet those needs.

I am committed to staying ahead in the rapidly evolving field of research and analysis. This involves regularly attending conferences, participating in webinars, and pursuing additional certifications to enhance my skill set. I played a crucial role in conducting market research and competitive analysis. I have a proven track record of distilling complex datasets into clear, concise reports that have guided key business initiatives. Collaborating closely with multidisciplinary teams, I contributed to the development of innovative solutions grounded in thorough research and analysis.