Introduction and Current Market Scenario of the Satellite Payload Industry

The Satellite Payload Market plays a crucial role in advancing global communication, Earth observation, navigation, and scientific exploration. A satellite payload refers to the set of instruments, sensors, or communication systems carried by a satellite to perform its designated functions. These payloads vary in complexity and function, ranging from transponders for telecommunications to high-resolution cameras for remote sensing. Technological advancements in satellite miniaturization, increased demand for high-speed connectivity, and the growing deployment of Low Earth Orbit (LEO) satellites are key factors driving the market. Additionally, the expansion of defense and military applications, alongside commercial satellite launches, has significantly contributed to the industry's rapid growth.

Cognitive Market Research noticed that the demand for sophisticated satellite systems in a variety of industries, including telecommunications, defense, and Earth observation, is the primary driver of significant growth in the global Satellite Payload market. The Satellite Payload market was estimated to be worth approximately USD 4124.5 million in 2024 and is projected to increase to USD 24900.4 million by 2032, with a compound annual growth rate (CAGR) of 25.2% during the forecast period, according to a recent market analysis. In June 2023, a leading aerospace company developed an innovative modular payload system designed to enhance satellite functionality and improve mission flexibility. This development is expected to drive further adoption of advanced satellite payloads in commercial and governmental applications.

What are the current trends of the Satellite Payload Market?

Based on the research conducted by Cognitive Market Research the global Satellite Payload market is estimated to be worth approximately USD 4124.5 million as of 2024. This market size reflects the surging demand for satellite-based services, particularly in telecommunications, broadband internet, and Earth observation. The proliferation of small satellites (smallsats) and CubeSats has reshaped the industry, making satellite deployment more cost-effective and accessible for commercial applications. Government agencies and private enterprises are investing heavily in satellite technologies to enhance global connectivity and security. The market is anticipated to expand at a compound annual growth rate (CAGR) of 25.2%, with a market value of approximately USD 24900.4 million by the conclusion of 2032. The rapid advancement in satellite propulsion systems, the increasing reliance on AI-driven satellite operations, and the integration of software-defined payloads are primary factors fueling this growth. The market is also expanding due to rising demand for high-throughput satellites (HTS) to support next-generation telecommunications and data transmission networks.

North America accounted for approximately 38% of the total market in 2024, constituting the largest market share in the global Satellite Payload market. The dominance of this region is attributed to strong investments from government agencies such as NASA, the U.S. Department of Defense, and private players such as SpaceX and Blue Origin. The presence of established aerospace and defense manufacturers further strengthens North America's leadership in satellite payload development. Europe holds a 30% market share, supported by growing investments in space research and satellite communication infrastructure. The Asia-Pacific region is rapidly expanding, currently holding a 25% market share, driven by increased satellite launches from China, India, and Japan. With significant government funding and private sector involvement, Asia-Pacific’s market share is expected to grow to 28% by 2025, recording the highest CAGR of 27.5% among all regions. The surge in commercial satellite programs, expanding space agencies, and the rising demand for Earth observation data are the key contributors to this exponential growth.

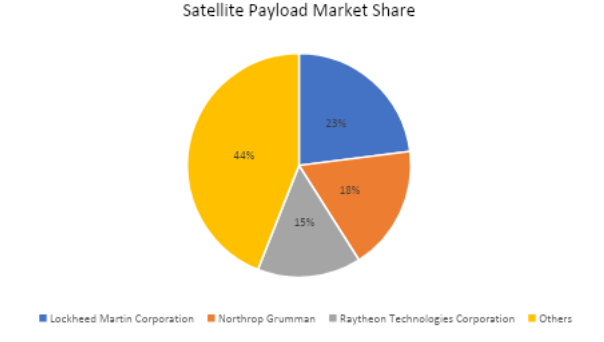

The satellite payload market is highly competitive, with several leading players maintaining a strong foothold in the industry. Lockheed Martin Corporation, Northrop Grumman, and Raytheon Technologies Corporation are among the most significant companies shaping the market landscape. Lockheed Martin Corporation held the largest market share in 2024 at 23%, followed by Northrop Grumman with 18% and Raytheon Technologies Corporation at 15%. These key players continue to invest heavily in research and development to enhance payload capabilities, improve miniaturization, and increase efficiency, thereby securing their competitive advantage. The market is also characterized by strategic mergers, acquisitions, and partnerships, enabling companies to expand their technological expertise and global reach. With increasing demand for advanced satellite communication, Earth observation, and defense applications, competition is expected to intensify by 2025, particularly in emerging markets across the Asia-Pacific region.

Satellite payloads remain essential for a wide range of space-based applications, including communication, navigation, remote sensing, and scientific research. Compared to traditional transponders and optical payloads, advanced satellite payloads accounted for approximately 45% of the total satellite technology market in 2024, with traditional transponders at 35% and optical payloads at 20%. While optical payloads are valued for their high-resolution imaging capabilities and traditional transponders remain widely used for commercial broadcasting, advanced payloads are increasingly preferred due to their enhanced data processing capabilities, higher frequency bands, and multi-mission flexibility. The market share of advanced satellite payloads is projected to rise slightly to 47% by 2025, driven by growing investments in next-generation satellite networks, deep-space exploration, and defense-related space programs. This technological advancement highlights the increasing reliance on sophisticated satellite payloads for high-performance and mission-critical applications.

High Development and Launch Costs Constraints the Satellite Payload Market

Despite the strong growth trajectory, the satellite payload market faces several challenges, including high development and launch costs, regulatory constraints, and spectrum allocation issues. The complexity of payload integration and the need for rigorous testing and validation processes increase production costs and time-to-market. Developing a satellite payload involves multiple stages of research, prototyping, and testing, all of which require significant financial and technical resources. These costs can pose barriers for new entrants and smaller companies looking to participate in the market. Additionally, the growing congestion in LEO and GEO orbital slots raises concerns about space debris management and collision risks, necessitating the development of advanced space traffic management solutions to ensure long-term sustainability.

Another significant challenge is the dependence on reliable launch services. The availability of affordable and frequent launch opportunities is critical for sustaining satellite payload deployments. Delays in launch schedules and failures in launch vehicles can impact market dynamics and project timelines, affecting both commercial and governmental satellite programs. Companies must navigate these uncertainties by diversifying their launch options and leveraging emerging rideshare models to improve cost-efficiency and scheduling flexibility. The regulatory environment also plays a crucial role in shaping the market, with spectrum allocation and licensing requirements influencing the deployment of communication payloads. Governments and regulatory bodies must work collaboratively with industry stakeholders to streamline regulations and facilitate smoother market entry for new technologies and applications.

Expected Future Developments in the Satellite Payload Market

The satellite payload market is poised for substantial advancements as industry stakeholders continue to push the boundaries of technology and innovation. The integration of reconfigurable and software-defined payloads will become more prevalent, allowing satellites to adapt to changing mission requirements dynamically. This trend is expected to improve operational efficiency and extend the lifespan of satellites by enabling in-orbit modifications and upgrades. As a result, satellite operators can optimize performance and functionality without the need for costly replacements, making satellite networks more sustainable and adaptable to evolving demands. A major milestone in the market was achieved in January 2025 when SpaceX successfully launched 131 payloads into low Earth orbit as part of its 12th rideshare mission. This mission underscores the growing demand for rideshare launch services and the increasing number of small and medium-sized payloads entering orbit. The success of such missions demonstrates the viability of shared launch platforms, reducing costs and enhancing accessibility for satellite operators. The proliferation of smaller, more cost-effective satellites is enabling a wider range of commercial and research applications, fostering innovation across industries such as agriculture, environmental monitoring, and remote sensing.

In addition to advancements in launch capabilities, the development of quantum communication payloads is expected to revolutionize secure communications in space. Quantum key distribution (QKD) technology is being explored as a means to achieve unbreakable encryption for military and commercial applications. Several countries are investing in QKD-enabled satellites to enhance cybersecurity and data protection in space-based networks. The implementation of quantum encryption could set new standards for secure global communications, providing governments and enterprises with advanced security measures to protect sensitive data from cyber threats and espionage. Furthermore, advancements in miniaturization and additive manufacturing are expected to drive cost efficiencies in satellite payload production. The use of 3D printing for payload components is gaining traction, enabling rapid prototyping and reducing manufacturing costs. These innovations are accelerating the development process and making it easier for companies to produce high-performance satellite payloads at lower costs. As these technologies mature, satellite payloads will become more sophisticated, compact, and cost-effective, making satellite-based services more accessible to a broader range of industries and applications.

Conclusion

The satellite payload market is undergoing a transformative phase, characterized by technological advancements, increased commercialization, and expanding applications across various sectors. The continuous innovation in software-defined payloads, AI integration, and high-throughput satellite systems is set to redefine the market landscape. To capitalize on these trends, industry players must invest in research and development, foster strategic partnerships, and explore cost-effective manufacturing techniques that enhance both performance and affordability.

Additionally, addressing challenges such as regulatory constraints, spectrum management, and launch service dependencies will be crucial for sustaining long-term growth. Collaborative efforts between governments, regulatory bodies, and private companies will play a vital role in creating a more efficient and sustainable satellite ecosystem. As the demand for satellite-based services continues to rise, the satellite payload market is expected to play a pivotal role in shaping the future of global communications, Earth observation, and space exploration. By embracing emerging technologies and innovative business models, the industry can unlock new opportunities and drive sustained growth in the years to come.

Author's Detail:

Sneha Mali /

LinkedIn

Sneha Mali is a research analyst working in various domains including the Consumer Goods, market research and transport & logistics and her primary responsibility is to conduct thorough research on various subjects and provide valuable insights to support client requirements. Her knowledge of research methodologies, and data mining which enables me to analyze large data sets, draw meaningful conclusions, and communicate them effectively.Sneha stay up-to-date with the latest research trends, methodologies, and technologies to ensure that her research is accurate, relevant, and impactful.

In her current role, Sneha is committed to continuous learning and staying abreast of emerging trends in research methodologies. Regular participation in workshops, webinars, and industry conferences ensures that her skills remain sharp and relevant. She have demonstrated ability to transform complex data sets into clear and concise narratives that inform key business strategies. Collaborating with cross-functional teams.Sneha remains an invaluable asset in the dynamic landscape of market research.